If you cannot clearly define Stake, ROI, Yield, and Profitability, you are probably still a long way from turning betting into profit.

This article was originally published in late 2015 and reflects thinking from that time. While much of the core logic still holds, the landscape has changed – and so have we.

We’re currently replacing and expanding our betting education series with deeper, more structured material.

More updated articles to follow soon.

The terms Stake, Yield (Revenue) and ROI (Return on Investment) confuse many people. We have also noticed many online publications using these terms incorrectly.

This article is therefore a definitive guide to put the record straight…

Stake

The sum of money gambled on the outcome of an event. The amount of money played with, or placed as a bet.

In the online world of gambling, stakes are electronically placed on a desired outcome with another party that has agreed to accept your stake, whether this be a bookmaker or an anonymous person/group in a betting exchange.

These ‘adversaries’ are effectively backing with their own money against your selection, hoping to make a profit of your stake if your selection in the event turns out to be wrong.

Once the outcome of the event is decided, stakes are returned to you in full if your bet has won (plus the winnings), or, if you lose the bet, the stake is lost and either retained by the bookmaker, or transferred to the winning side in the betting exchange.

Technically speaking, stakes are guarantees! This means that they are short-term deposit payments to guarantee that the losing party can and will honour his debt obligation to the winner of the bet.

Return on Investment (ROI):

The ratio of money gained or lost on an investment relative to the amount of money invested. In other words, the profit/loss ratio as a function* for investment† (capital employed).

*function = a relation or expression involving one or more variables; in this case, investment, profit, loss.

†investment = long-term employment of tangible, financial, or other assets that are not meant for immediate gains but are intended to generate benefits (normally earnings or profits) in the future.

ROI is also known as ‘rate of profit’ or sometimes just ‘return’.

ROI Formula:

If you bet systematically, your starting capital will be turned over again and again: It is effectively the same money you are investing. (So long as you don’t lose every bet!).

The ROI formula resembles the yield formula, but here, profit/loss is related to the actual investment (starting bank) instead of the total of all stakes (turnover).

For a more accurate ROI calculation, in an ideal world, you should also factor in to the investment all other costs of ‘setting up the business’. For example, hardware/software costs (computers). However, we will leave this out of our calculations for the time being for the sake of simplicity; you can always include these costs once you have mastered the concept. 😉

Returning to our previous illustration, 38 bets were placed, each with a stake of 20 units (760 units staked in total). 5 bets lost but the overall bank growth was 65 units. Let’s assume the starting bank [investment] was 200 units.

![]()

ROI in this example is 32.5%

ROI is always calculated for a certain predetermined amount of time; in finances usually for one whole year, but it is also common and acceptable to calculate the ROI monthly or, in a betting sense, for only the number of bets within a specific time scale.

The return on investment index is especially suitable when the amount of capital has a strong influence on the result (e.g. with arbitrage).

However, this is probably rarely the case for the majority of punters. Therefore, it is the next formula, profitability, which is the most important one for the normal bettor.

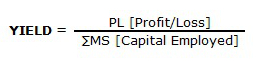

Yield

The Profit/Loss* ratio† applied to the total capital employed (total staked)

*This is Profit or Loss, NOT Profit divided by Loss

†ratio = the quantitative relation between two amounts showing the number of times one value contains or is contained within the other.

Literally translated, the term YIELD means profit, earnings, harvest, income, revenue…

When applied to gambling, Yield measures betting efficiency compared to total turnover.

If your aversion to risk is low, you will select bets with higher probabilities. Bets with higher probabilities of winning carry lower odds. Lower odds means a smaller yield.

If you enjoy higher risk strategies, the opposite will apply.

Generally speaking and depending upon the strategy employed, a good bettor will yield between 5 and 10 percent profit in the long run.

In football betting any yield over 7% is considered to be a very good result.

Yield Formula:

PL divided by ∑MS (written as a percentage):

PL = profit/loss (MW minus ML = net profit or loss); equivalent to your bank growth

∑ = the sum of

MS = money staked

MW = money won (purely winnings; returned stakes are ‘neutral’, not winnings)

ML = money lost (stakes lost)

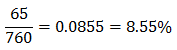

A bettor places 38 bets with stakes of 20 units each. The total amount staked [Capital Employed] is 760 units (38 x 20). 33 of the bets win and 5 of the bets lose; the net result [Profit] is a bank growth of 65 units.

Yield in this example is 8.55%

We come across many forum threads with people talking about their betting strategies; It is also easy to find plenty of websites offering betting systems for sale.

What many of them have in common is claims of high yield results, probably intended to impress the reader.

If they are to be believed then this is an indication of high risk strategies employed.

It must be remembered that in the Yield formula, the sum of money staked (∑MS) includes all stakes, even those that have not been lost. (In other words, the refunded ‘guarantees’).

People tend not to understand this fully and as a result mistakenly overstate their yield results.

Yield is NOT the same as ROI (Return on Investment)!

Profitability

The relation of profit/loss to the money spent. In other words, profitability is an index for measuring financial success (operational profit) in relation to the costs of running the business.

Profitability is THE key indicator that makes betting success measurable and controllable.

We reiterate: Measuring OPERATIONAL Profit!

Profitability measures success connected to the operation (running costs) of the business (not the start-up capital, and also not the turnover of all stakes).

Stakes are strictly speaking just short-term deposit payments which are returned to the bettor should his bet win. Investment (start-up capital) can be anything – some people may prefer a higher bank than others. However, profitability is the same for all, and therefore a much stronger success indicator than any ROI or yield calculations.

Again, in an ideal world, one would factor in the costs of power, heating and light; apply an hourly rate to the time spend in all aspects of the venture; even the food you eat at your work station.

However, to keep it simple, we only factor in the amount of stakes lost [the money spent operating your betting venture].

Profitability Formula:

In contrast to the yield, where the turnover of all bets counts, or to the return on investment, where the starting capital counts, profitability is all about the truly invested money (money lost or spent running the betting business).

It is, therefore, the most important and realistic index for sports bettors to quantify the overall financial reward they receive from their betting ventures.

Back to our example: Five of the 38 bets lost. The sum of all money lost, ∑ ML, therefore is 5 x 20 unit stakes per bet = 100 units lost. If you remember, bank growth was 65 units.

![]()

Profitability in this example is 65%

Understanding the Terms: Yield, ROI, Profitability

We sincerely hope that your understanding of the three different indexes, yield, return on investment, and profitability is now crystal clear.

Summary of the Exercise

Our bettor placed 38 bets with stakes of 20 units each. The total amount staked [Capital Employed] was 760 units (38 x 20). 33 of the bets won and 5 of the bets lost; the net result [Profit] was a bank growth of 65 units.

The starting bank [Investment] was 200 units. The sum of all money lost [Running Costs], ∑ ML, was 100 units.

By the way, the betting odds although not mentioned anywhere were 1.25. Otherwise the good hit rate (33 out of 38 bets) would not have been achievable.

The Yield in this example: 8.55%.

The ROI in this example: 32.5%.

The Profitability in this example: 65%.

The betting odds were very small: 1.25 and therefore the turnover to win 65 units pretty high which led to a small yield: 8.55%, but 65.0% profitability!

5 of 38 bets lost, 33 bets won. Hit rate: 86.8%

Can you see that there is a connection between hit rate, odds, yield and profitability?

Measuring your betting success is absolutely essential. You should always be in a position to know whether all the time, effort, and money you have spent is actually worthwhile.

Let’s do another Exercise

Our betting enthusiast starts with an initial bank of 850 units and places 50 bets with stakes of 10 each at average odds of 3.33.

17 bets win, 33 bets lose.

- What is his hit rate?

- What is the yield, return on investment and profitability in this example?

- Is this a ‘riskier’ strategy than the earlier example?

- Can you judge the risk of a strategy by looking at the yield, ROI and profitability numbers? What is the connection?

Try to work out the answers yourself before downloading them for free below. You’ll also find more exercises to test your newly learned skills!

Practice, Practice, Practice!

Yield, ROI (Return on Investment) and Profitability

Just click on the button above and click on “Proceed to checkout” button in the new tab, then enter your name and e-mail address. Our automatic service will then deliver the file to you via e-mail, free of charge. The size of the PDF file is 230KB.

If gambling is a full-time job for you then weigh up the results against the salaries of other jobs you are qualified for or have a chance of securing. If it’s a hobby or part-time job, again compare the final income with what you could have earned elsewhere in the time that you’ve spent.

As always, thanks for reading! Feedback and comments are always welcome, as are shares, loves and likes in social networks! 🙂

If you have enjoyed this article then why not visit What is a Bet? What are Odds? What is a Stake?, another informative piece containing vital ‘need to know’ definitions, including how to calculate mathematical advantage.

In your Example #2: ROI, your starting bank was 200 units giving an ROI of 32.5%.

If MY starting bank was 500 units then the ROI would be 13% (65 divided by 500).

Since we both staked 760 units and made the same profit how can we end up with different ROI figures?

If you can end up with different ROI figures then it becomes impossible to use it to compare investments/betting systems/tipsters…

In neither case above have you invested either 200 or 500 units. You have only used that money to allow you to start the process of actually investing 760 units which makes the ROI = 65/760 = 8.55% which is what you are calling yield.

(If you can end up with different ROI figures then it becomes impossible to compare systems/methods/tipsters using ROI.)

Investopedia’s definition of yield is

Yield = Net Realized Return / Principal Amount

Doesn’t the word “return” suggest it includes your original investment? Used in the same way in the world of betting where “the Returns from a bet are the amount you get back if all or part of the bet wins”?

I’m with JT on this one I’m afraid. You’ve got yield and ROI the wrong way round.

Sorry to disagree guys but our definitions of yield and ROI are definitely correct.

Return on investment is simply that – the ‘return’ generated by the total amount of investment churned into achieving the return.

Your statement is that “Return on investment is simply that – the ‘return’ generated by the total amount of investment churned into achieving the return.”

The amount of investment churned is 760 units therefore

ROI = ‘return’/760

and not

ROI = ‘return’/200

Irrespective of what you mean by ‘return’ the divisor is 760 not 200.

Hi everyone,

the ROI is ‘Return on Investment’; and investment is what has been ‘invested’ = lost (200)

Take an example… You rent a car during your holidays and the agreed rent is 200. However, you are asked to put down a deposit of a further 560 in case you damage the car.

Option 1: These 560 are returned to you after the car is returned undamaged and, therefore, only 200 is recorded as your costs (= investment) for the car hire during your holidays.

Option 2: However, if the car was damaged then you may only be returned 360 of your 560 (perhaps 200 of the 560 was retained to cover the repairs); then your ‘investment’ for car hire would have been 400 (200 rent + 200 damage excess) during the holidays.

ROI is tricky if seen in connection with stakes and gambling, but please always remember, you have not lost your stake until the event has actually been played and the result is known. The stake is therefore always just a deposit payment in case you lose the bet – this is a ‘guarantee’ the bookie has that the bettor actually pays his debt. The stake (deposit) is always returned to you if your bet wins, plus your winnings.

The amount of stakes churned is 760 units; that is YIELD

YIELD = ‘return’/760

and the amount ‘invested’ ~ stakes that have been actually lost;

ROI = ‘return’/200

Hope this makes sense!

Soccerwidow

Hi,

Remains one question.

If you are just starting and in 10 bets you hit all 10 you can’t devide by 0. So how do you calculate your profitability in this case? Of course you just need to loose one to be able to devide and that will happen sooner or later but till then how do you calculate it?

Hi Hugo,

this is a very theoretical question… if you can’t divide by 0 then divide by 0.000001 😉

Thanks soccer window for a great article on yields over betting exchanges. Just to understand some concepts.

Suppose that these are the odds for 10 bets with a stake of 100 unit each with strike rate of 7 and lost of 3.

1.23, 1.44, 1.55, 1.34, 1.47, 1.60, 1.28, 1.50, 1.36, 1.27

Do we take average like above is 1.404 and work out money won as:

MW = (10 * 1.404 * 100). – (7 * 100) = 704

ML = (3 * 100) = 300

PL = 704 – 300 = 404

Yield = 404/10 = 40.4%

Or do we Sum all odds with their stake? Example

MW = (1.23*100) + (1.44*100) +(1.55*100)+( 134*100)+( 1.47*100)+(1.60*100)+( 1.28*100)+( 1.50*)+( 1.36*100)+(1.27 *100) = 1404

Hi Dalan,

both work…

Your first calculation: Yield = 40.4%

Your second calculation… a little bit continued..

1,404 / 1000 (total staked) = 1.404

1.404 minus 1 = 0.404 = 40.4 % Yield

Hi Soccerwidow,

Sorry as this will sound a very silly question. For record-keeping purposes, I’m a bit sure how to proceed on this.

If you’re using betting exchange, should you factor in the commission fee into the Money Won calculation?

E.g. I think Betfair take 5% commission.

Just using the unaltered yield formula. Let’s say one were to place 40 bets with stakes of 100 units each and with average market odds of 1.50. Let’s suppose that 32 bets hit, and 8 bets miss (although I fear such a great yield may be wishful thinking).

Using the theory, it should look like

Money Won= (32 * 100 * 1.50) – (32 * 100)

= 4800 – 3200

=1600

Money Lost= 8 * 100

=800

So PL = 800

And Money Stake

So that’s a total money staked = 4000.

Yield = PL/MS

=800/4000

=0.20

=20%

But if we include a commission fee of 95%, Money Won should surely be:

MW= (((32 * 100 * 1.50) – (32 * 100)) * 0.95)

should it not?

I’m just wondering when most people talk of Money Won and Yield, are they taking out the commission fee? It gives us a difference in yield of 18% compared to 20%

Sorry for such a long and dumb question.

Kind regards,

Audiendi

Hi Audiendi,

yes, you have to factor in the 5% commission fee of Betfair; Germans have to factor in the gambling tax, etc. etc.

You’ve calculated right and I’m going to repeat your example, including the BF commission, for the sake of other readers:

40 bets with stakes of 100 units each, average market odds of 1.50; let’s suppose that 32 bets hit, and 8 bets miss

Money Won= (32 * 100 * 1.50) – (32 * 100)

= 4,800 – 3,200

=1,600 – Commission 5%: 80

= 1,520

Money Lost= 8 * 100

=800

PL = 1,520 – 800 = 720

Total money staked = 4000

Yield = PL/MS

=720/4000

=0.18

=18%

I’ll write an article on that topic one day but currently I’m incredibly busy getting the German Over/Under course finished and in print.

Have a great Easter and help us to spread the word that we currently have an Easter sales running!

Thank you,

Elena

Cheers Elena,

Happy Easter to you and the family.

Kind regards,

Audiendi

Hey Guys,

Do you mean initially the bank was 200 units (perhaps 10 bets of 20 units were initially placed?). The bettor (presumably) collected profits from those first 10 bets. The bettor then made more bets so from the winnings so that, in total 760 units ended up being staked (a total of 38 bets of 20 units)?

I just couldn’t quite follow 760 units were staked (38 bets of 20 units) yet how can there be a starting bank of 200 units?

Kind regards,

Audiendi

Hi Audiendi,

the starting bank of 200 units is an assumption based on The Science of Calculating Winning and Losing Streaks.

Further, this example is based on a low risk strategy (38 bets in total, 33 win: 86.8% hit rate; odds: 1.25) and, the example is based on the assumption that the bettor doesn’t place all 38 bets at the same time. Should that be the case then, of course, 200 units’ starting bank wouldn’t be enough.

So, say… starting bank 200 units… placing 10 bets in total (20 units each)… after these 10 bets your bank will be (depending on winning/losing) somewhere in the region of 140 units (if you were very unlucky, and 3 bets lost in the first betting round) up to 250 units (if all bets won). Then you can turn-over your bank again… and again… and again… That is why you get different numbers for turnover (Yield) and starting bank (ROI).

Wrong. You have ROI and yield backwards. ROI is calculated as profit / total units wagered.

Hi JT,

I don’t have it wrong. The explained definitions are definitions from the financial world applied to sports betting. Look up Wiki, Investopedia, and so on… not forums!

Hi! Do you have any plans to release any more courses?

Hello John,

There is a 1×2 course in the pipeline, but I’m afraid I cannot be specific about the time scale for its release.

Apologies for the uncertainty.

What a great article! Thanks to you guys I’m currently taking a statistics course to learn more about how this all works. Can’t wait for your new value calculator to come out!